Looking for information about payments on your Sun Life policies like Sun Maxilink Prime, Sun Flexilink, Sun Maxilink Bright and other Sun Life products? Let me share you some of the frequently asked questions I have received over the years.

I’ve collected and compiled them here – some of the most asked questions when it comes to Sun Life VUL and traditional (term, etc.) payments. Here are some of them:

Updated: January 2024

How to Pay Sun Life Insurance Policies Complete Guide

Regarding Sun Life Mode of Payment

My current mode of payment is quarterly, can I change to Annual? or vise versa?

Answer – Yes, you may change mode of payment anytime as long as it’s advanced. That way, you won’t be lagging in your payment schedule. However, say your initial mode is quarterly and you paid in Annual, you will still receive the quarterly billing since it’s computer generated. In case you don’t want to receive the quarterly billing, we need to change that in paper, there’s a form we need to submit. Or you may simply ignore the quarterly billing.

Can I pay on a Monthly basis? I started annual but I want to change to monthly. What to do?

Answer – You can pay monthly as long as it is advanced. Ideally, to do monthly payments, initial payment is either quarterly, semi annual or annual. So you pay the first 3 months, then you immediately pay the monthly the next month. That way, when the next billing comes, you already completed the 3 months in advanced. Same goes with Semi Annual and annual. It has to be advanced.

Can I pay in Advance? I want my Sun Maxilink Prime policy to be paid in just 5 years.

Answer – Yes, that’s possible. For example, your plan is P30k a year for 10 years. Instead of paying 30k a year, you may do P60k a year for 5 years. As long as you fulfill the total payment of 300k in 10 years or less, that’s ok.

Can I pay a little more than my billing? My quarterly billing is P7,156.75, I always get irritated with the ‘butal’.

Answer – Yes, you can pay any amount to be exact. In the example, instead of P7,156.75, you can actually pay P7,200 or P7,500. Any excess payments that you make will be added to the fund value, so it will not go to waste.

Can I pay my Sun Maxilink Prime using credit card? Sayang kasi ang points.

Answer – Yes. For New applications, credit card payments are accepted up to Php 2Million. For existing plans, Credit Card payments are possible thru Sun Life mobile app or Web app and via Auto Credit Charging with no limit.

I haven’t paid for like 12months to 1 year. Can I still make deposits to my policy? Can I still make up for skipped payments?

Answer – If it is a VUL Policy (Maxilink Prime, Maxilink 100, Flexilink), yes it is possible. The good thing with VUL plans is that, it doesn’t automatically lapse or terminate. If you haven’t received any notification that your policy lapsed, most likely, it is not. If it’s not yet lapsed, yes, you may continue your deposits. You can also make up for skipped payments. If unsure on how much you should pay, let me know so that we can take a look at your policy. Best to check with your Sun Life advisor or thru Sun Life mobile or web app.

Sun Life Payments thru Banks – Over the Counter

You may also pay your Sun Life policies thru Sun Life accredited banks.

What are the banks accredited with Sun Life and how do I pay my premium over the counter?

Here are the list of accredited banks with Sun Life Financials

- Bank of the Philippine Islands (BPI)

- Banco De Oro (BDO)

- Rizal Commercial & Banking Corporation (RCBC)

- Security Bank & Trust Company (SBTC)

- UnionBank of the Philippines (Unionbank)

To pay over the counter, simply follow these steps

- Go to any of the accredited banks nearest your place.

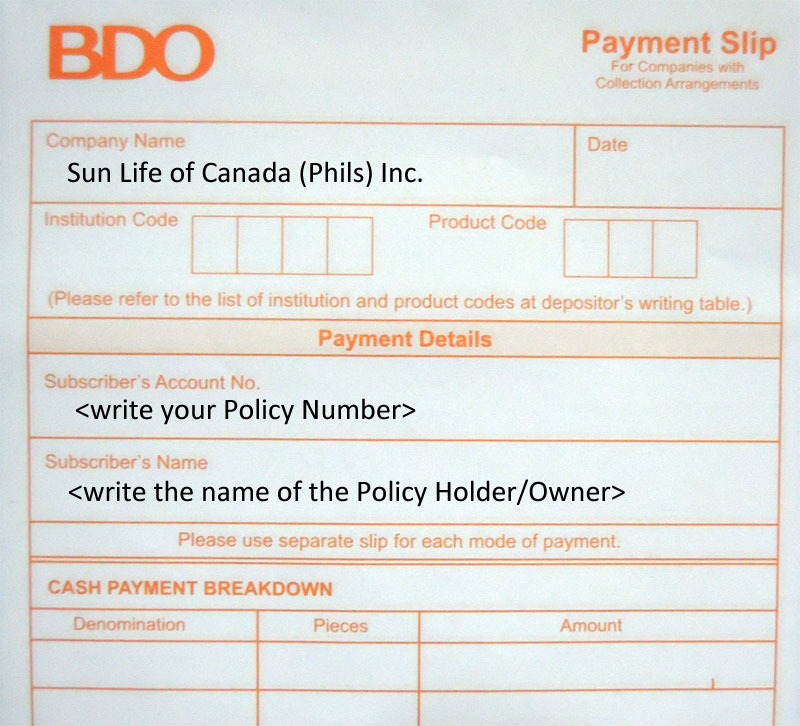

- Using the Bills Payment Slip, write Sun Life of Canada (Phils) Inc. as the Merchant / Company Name

- On the Subscriber’s Account No., write your Policy Number.

- On the Subscriber’s Name, write the Name of the Policyholder / Owner.

Online Banking – Sun Life Payment via BPI / BDO Online

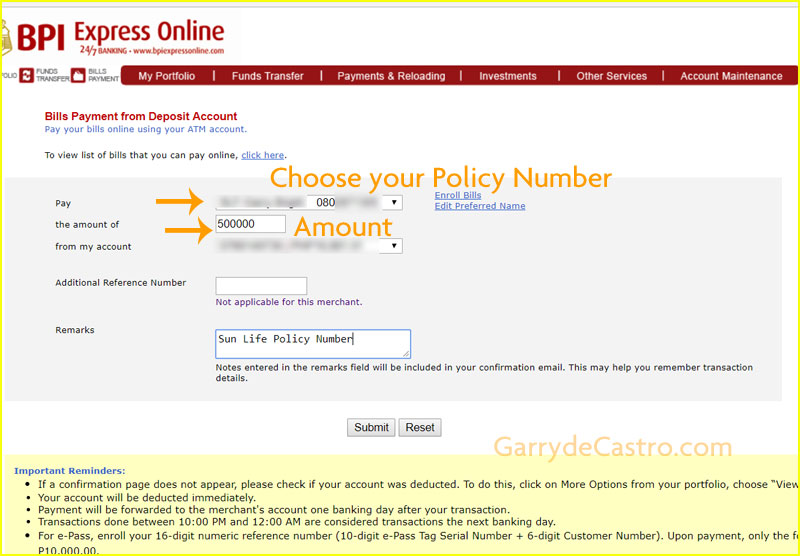

How do I pay using bpi.com.ph?

Enroll First

- Login to your bpi.com.ph account

- On the Menu, go to Payments and Reloading -> Bills Payment -> Enroll All Other Bills

– Company Name is Sun Life of Canada (SUNLIF)

– Reference Number is your Policy Number

– Click Submit

Make Payments

- Go to Payments and Reloading -> Bills Payment -> Pay Bills Today

- Pay (choose from Drop Down – SLF…)

- Amount

- Then submit

Other Sun Life Payment Options

You may also pay your Sun Life policies thru the following facilities

- Sun Life Stores

- Gcash / Maya

- ATM Facilities (Bancnet)

- SM Bills Payment Center

- Bayad Center

- Smart Money

Garry De Castro is a personal finance advocate, Financial Advisor, Certified Investment Solicitor (Mutual Fund Representative), investor, stock market trader, blogger, and IT practitioner. He started sharing and writing financial articles 2008 just to share his financial learnings to friends, relatives and anyone who wishes to be financially independent.

We currently pay are VUL Policy every quarter, can we pay in advance and pay for 4 qtrs? Thanks.

Yes, that’s possible. Just disregard the regular billing statement since it’s computer generated. Not unless you want to have it changed on record, you will need to submit a Financial Amendment form thru your Sun Life Advisor.

Hi Sir Garry,

We’re so glad we found this page as you’re answer to the Sun Life Questions are spot-on, clear and understandable. Thank you sir. ?

We have read through all comments and yes, we have questions. My family all have Sun Life Policies, my two kids have the Sun Life Maxi Prime, and both me and my wife have the “Sun Life Flexilink” as we got those 10 years ago. Our question is for our “Sun Life Flexilink”, as we understand we just have to pay 10 years and we can stop payment and the fund value should be able to sustain (Our 10th year was last February 2023, and we pay quarterly and we already exceeded two [2] quarters of extra payments). So here are our questions:

1. Is it better that instead of full stop payment we just pay the Admin Fee, then add an extra amount so that will go to VUL/Investment Fund? This way our quarterly payment is way less than what we normally pay. (Example only: On Mobile App we can see the transaction history and just a made up number, say the Admin Fee/Charge is 500php || can we just pay 500 then add +1k so 1500php?), will the Sun Life system detect to deduct the admin fee then add 1k to investment?

Hi Paul, first of all, congratulations. Knowing that your whole family is insured.

With regards to your question on Flexilink, yes that’s a better approach. Paying the monthly admin charges then adding more will have a better chance on increasing the fund value. What really happens when we make deposits is that it is converted to units using the current Net Asset Value Per Unit (NAVPU)and are added to the existing units. And to pay the monthly admin charges, units are then converted to cash using the NAVPU on that date.

Thank you and understood, and I appreciate your prompt response, Sir Garry. I have a follow-up inquiry. Is it necessary for us to reach out to Sun Life or our financial advisor and complete any forms or similar procedures to modify the payment method or scheme? This action will ensure that the Sun Life Mobile App and Sun Life Online are updated accordingly. Or is such action unnecessary? Our objective is to have the system display the “Total amount due” as the new value, not the old one.

Hi Paul, since this action is a manual ‘strategy’, we cannot make any changes with regards to Sun Life’s billing statement. Please expect that Sun Life will send the usual billing statement. You may just disregard and pay manually. The total amount due will always be your original premium.

Hello po,nagpay ako advance ngayon ng traditional plan ng anak ko elite peso 10 may 30 pero yung due date pa kasi is sa june 28 pa ginamit ko psbank mobile banking on payment mga ilang days po bago magreflect sa mismong sunlife yung payment ko?salamat po

Payments usually reflect after 3 banking days..

Hello po,

Enrolled po ako ng Maxilink and updated po anh payment ko and plan ko po mag advance payment ng 60k pero sa fund value ko po sya ipa lagay and sa next na billing ay dun ko na ipa bawas, pwede po ba yun and ano po mangyayari kung sakali.

Any advance payment sa Maxilink prime will be considered top up. Yes it will be added sa fund value and invested.

Re: Pwede ba xa magamit sa next billing, technically yes. Altho you will still receive the billing statement as it is computer generated.

Hi, I have 2 VUL plans with Sunlife (Sun Maxlink Prime), and I wish to discontinue it permanently due to personal reasons. Will I be able to withdraw 100% of all the money that I’ve invested plus the earnings? Is there a way to do this without coursing it through my agent? May be course it through the Sunlife office directly? I’m really decided na kasi.

If you surrender your VUl plans, what you will get is only the current fund value.

Is there a way to do without going thru your Sun Life Advisor? Yes, by going directly to any Sun Life Centers.

Hi question po, due to pandemic hindi po namin nahulugan ang maxilink prime accnt policy namin. Pang 10th year na namin sa sep supposedly tapos na sana kung d lang nahirapan ng dumaan ang crisis but good thing there is still enough fund sa vul. What will happen sa account kung hindi pa nafully settle ang balances by the time the policy payment term ends? Pwede pa din po ba masettle installment ung balances even after 10 yrs? Nagwoworry po ako baka maglapse or materminate policy namin. Thank you in advance.

That’s one of the best features of Maxilink Prime. As long as there is enough fund value to shoulder the charges, the policy will not lapse immediately. Sometimes it will take years before the fund value is depleted.

If you have skipped payments, yes pwede pa mahabol xa. Pwede mo pa bayaran kahit lampas na sa due date as long as the policy is still inforced.

Hello Sir, what can I get after being able to pay my 10 year insurance policy (Sun Maxilink Prime)

You may request for a Certificate of Payment from your Sun Life Advisor

Hello Sir Garry! Glad that i found your website! Very informative!

I would just like to ask po, since it’s pandemic, i wasn’t able to pay my VUL for 1 yr. My penalty fee po ba for late payments? And another question po, gusto ko po sna kc dati na annual po ang payment ko kaso quarterly po ang current payment ko, as per my financial advisor ko po kc, no problem if i will pay ng isang bagsakan kahit na quarterly ang payment ko. Ang worry ko po is prang late ung payment ko lagi kc for the last 2 yrs, end of the year po ako lagi nagbabayad. May effect po ba un sa vul ko po? Thank you in advance po.

Hi Grace, yes that’s possible. May penalty ba? The good thing with VUL, walang penalty. May effect ba sa VUL if late nagbabayad? You’re just missing the opportunity for the fund’s earning potential. The earlier invested, the better.

Hi Garry. What’s why am I getting 1,400/mo in admin charges and 700/qtr in transfer charges? My monthly premium is 5000. That’s 32% of my premium going to charges. Currently on my 3rd year paying.

Hi Seph, with very limited info, I can’t make assumptions on the kind of policy you have and attached riders if any. Best to ask for a policy review from your Sun Life Advisor. He/She can best explain the details to you.

Hi po, just want to clarify po. Does sunlife still charge admin and transfer fee even if after we have completed paying the whole 10 years?

Hi Sarah, no more transfer fee. Just the admin charge since it’s being used to pay for the insurance part.

Hi!

I have SUN MAXILINK PRIME.

I do not have copy of the “contract” and my SUNLIFE Advisor is no longer with SUNLIFE. My questions are: how long should I pay (I pay 70k/year and 50k/year for my daughter), is this for 10 years or for a lifetime? How do I get a new Advisor? Been thinking of voluntary withdrawal, why should I stay?

Hi Valeree, if your Sun Life Advisor is no longer connected with Sun Life, you may request someone you know to handle the servicing of your policy. Sun Maxilink Prime is 10 years to pay. After that, just let it stay there and it will start earning over time. Send me a message, I might be able to help re: getting a new Sun Life Advisor.

Hi Sir, after 10 yrs of paying do I need to still pay? I have sunlife maxilink prime, 30k yearly plan, what are the possible charges na continues padin babayaran until policy maturity? Thanks

Hi Ohwie, what you got (Sun Maxilink Prime) is a kind of limited pay VUL. Meaning, it was designed na 10 years ka lang magbabayad then stop ka na and your policy can self sustain on a normal market conditions up to age 88 (depending on riders).

What are the possible charges until maturity? If you have CIB and HIB riders, expect to continue to receive billing notices for these. Also, your policy is continuously charged with the insurance charges etc but these are taken cared of by the fund value already.

Hi, I made an advanced payment of 18K. Also, my account is up to date. Upon checking, a transfer charge of 10K was deducted. What’s your policy on transfer charges? More than half of my payment just went to transfer charges. Can you clarify this.

Hi Joan, I may not be able to fully answer your question due to limited info – Product availed, issue date, mode of payment, how much have you paid etc.

If you want a more detailed answer, you may either contact your Sun Life Advisor or you may send me a direct message on FB Messenger.

Hi,

I originally applied to ADA for my BDO account unfortunately, BDO did not approved it. I am now paying my plan through GCash, is there anyway for the ADA to be removed in my account? I want to stop the ADA cancellation bill being sent to my home. Thanks

Hi Daniel, thanks for dropping by with your question. If your ADA was not approved, just wait for it to be removed in your account. It’s just a matter of time for it to reflect the status. But if all else fails, ask help from your Sun Life Advisor or you may check the Customer Service via Chat at http://www.sunlife.com.ph

Hi. Woould like to know pano po malaman if posted na yung payment mo. Thanks

Hi Mary, you may see it in the mobile app Sun Life PH or by logging in to your client portal in sunlife.com.ph

Hi Romel or Krystal, yes that’s the best case scenario. You can also take advantage of the low price of units since market is down.

If naglapse na yung policy, need muna ipa reinstate by submitting a Personal Declaration of Insurability + amount needed to reinstate the policy. Best to contact your advisor to check how much is needed for reinstatement.

Hi, sir clarification lang napansin ko po bukod sa admin chargers para saan po yung transfer charger every time na deposit ko na ang quaterly payment laging may transfer charges?

Thank you po sa sagot.

Hi Amelito, transfer charges are Premium Charges and excess premium charges. This is charged talaga every time a client deposits premiums or payments. Naka indicate po sya sa contract sir.

Hi…nalapse ko po payment ko for my daughter’s flexilink. Can i still pay for it? Thanks…

Hi Krystal, yes possible po mareinstate ang Sun Life policies within 3 years from the date na nag lapse.

Hi ulit po. So bayaran ko na lang yung na lapse ko together with the current quarter…

Hi Romel or Krystal, yes that’s the best case scenario. You can also take advantage of the low price of units since market is down.

If naglapse na yung policy, need muna ipa reinstate by submitting a Personal Declaration of Insurability + amount needed to reinstate the policy. Best to contact your advisor to check how much is needed for reinstatement.

Hello po, Sir. Ask lang po. I want to downgrade my Sunlife Maxilink Prime VUL from 5k to 2500/monthly. Naka quarterly payment po ang schedule ng payment ko. May next quarterly due po ay sa March 6, 2019 na 15k. Gusto ko na po sana ibaba now bago pa mag March 6. Possible po kaya yun? And ang ika- first year po ng policy ko ay sa June 6 pa. Thank you po.

Hi Czarina, my apologies for reading this late. Re: if pwede idowngrade, yes possible mag downgrade. You just have to check with your Sun Life advisor if possible to downgrade to that level.

Hi, I missed paying for my policy the last 3months. Can you help me confirm how much I need to pay to make up for it please? Great and helpful article by the way. ??

Hi Sheila, if you missed your payment, better check with your advisor first if it’s still active. If it is, you may need to pay your skipped payments but not required immediately.

Hi Gary,

I need your advice, Im already paying my sunlife for 8 yes, kaso meron akong 2 years unpaid , smarrt starter kit policy, maglapse n b ung policy.hirap ako bayaran lately kase 50k cis annually. Can you please give me the best that I need to do please.

Sb ng customer care n mappunta lang un s loan , so if wala ako mggawang payment what will happen? Please me ayoko mauwi to s wala please..

Hi Lunnie, due to limited details on your policy (traditional policy), I may not be able to give you the proper answer. Have you checked with your Sun Life Advisor?

Hi Sir Garry,

My deadline for quarterly VUL is last Sept. 15, 2019. I missed the payment (6k) and I am planning to pay partial this October 15. Is it okay if I pay 1k only then 3k on Nov. 15 then 8k on Dec 15, since Dec. 15 is the quarterly deadline (6k quarterly payment + 2k sept. 15 remaining)?

My VUL still has 8k+ fund as of today. Will my policy lapse?

Thank you, in advance, for your reply.

Short answer is YES, that’s possible and it won’t lapse.

Hi, hope you can advise me on this. I found some stale checks (dividends) that I was not able to cash in. What is the process to have them certified or to have them re-issued? Ty

Hi Mariel, you may need to surrender those cheques to have them replaced.

What will happen po if hindi ako agad makabayad nang quarterly payment ko within the 31 grace period after the due date? may penalty po ba? pero magbabayad naman po ako agad after the 31 grace period na binigay. Salamat sa pagsagot po.

Hi Mabelle, usual scenario if may enough fund value pa naman ang policy mo to cover the admin charges, wala naman penalty. Magkakaron lang ng penalty once your policy lapses and you’re not able to pay within the 31 days grace period.

Hi – I have an existing Sunlife flexilink and paying 80,000php a year. However, parang I noticed this is quite high vs other existing products you have then mababa lang yung returns 2MM … Pwede ba to mapachange pa to a lower amount even if I have paid for 5 yrs na

Yes, possible to downgrade to a lower premium, you will just lower the insurance coverage also. But before you do that, I suggest you make a policy review first with your Sun Life Advisor. For one, di mo na maibabalik ung age mo when you first got your plan, sayang naman.

Hi, nagstart po ako ng sunlife noong September 2018, quarterly po,9429.25 po per quarter, based from my advisor and unang hulog ko is for the month of September, October, and November para magbabayad nlng po ulit ako sa December 17, 2018, pero sa mga month na iyan nagkaroon ako ng administrative charge na 600+ per month mauubos na po ang fund ko dahil sa administrative charge na iyan at umasa po ako ng ang unang payment ko na yon is para doon sa mga month na naibnaggit ko.

kapag po ba binayarna ko yong mga month na iyon babalik yong total funds ko dapat na naibayad na?

total funds ko dapat today ay 25,000+ pero doon po sa aking fund value 6000+ lang po ang nag aappear, almost 20k po ang nawala? Bakit po naging ganun yon. Please paki paliwanag po sa akin. Salamat po.

Hi Geraldine. This is probably the most common misconception about VUL. A lot of people are expecting to see that their fund value is equivalent to the total payment they’ve made.

For one, VUL is an insurance product with investment component and not the other way around. A simple perspective to view VUL is that your fund value, based on projection will be equivalent on the total amount you deposited after paying the required years to pay.

For example, if it’s a Sun Maxilink Prime, you may see breakeven after the 10th year.

Bakit may administrative charge? Other charges are Premium Charge and Monthly Periodic Charge. They are needed for the setting up and management of our insurance policies. Imagine this, say we’re paying 10k per quarter. If death comes even after the first payment, Sun Life will give your beneficiaries a lump sum of your insurance coverage. Assuming 1Million coverage. Even if you only deposited 10k, death comes into the picture, Sun Life pays 1Million. Di ba ang laking leverage?

That’s what we’re buying in VUL. Bonus lang ung investment portion.

Sorry but in this case, I don’t blame you but your Sun Life Advisor. Important that any Insurance Advisor discuss these things thoroughly para lubos na naiintindihan ng clients.

hello!

I have sun fit & well na naka quarterly. Can I change it to semi annual terms of payment? How? Kaka start ko palang last March. Yung remaining quarters, gusto ko na sana gawing semi annual para less charges nadin. Living overseas na pala ako now because of work. Thank you!

Hi Anj, yes pwede mo change. However, possible mo lang ma change within the 1st 90days or every policy anniversary. Also need din ng signature mo (Financial Amendment Form) and copy ng ID. Also, if you have irrevocable beneficiaries, need din signature nila and ID as well.

Hi Sir,

May I ask, up to how many beneficiary should I add if I want a policy in Sunlife?

Thank you.

Hi Lyn, technically you may add as many beneficiaries you want to your Sun Life Policy. Altho based on experience, I highly recommend to limit it to 2-3 beneficiaries only.

Hello Sir Garry, thanks for the clarification on the premium holiday for the flexilink. Would like to know narin po if online payment is also available sa other banks? Listed biller po kase si sunlife sa chinabank

Hi Ars, if Sun Life is listed in Chinabank, you can try checking first how soon are the payments posted.

Hi just to clarify (medyo nakalimutan ko na kasi), kumuha ako ng sun maxilink prime policy, hindi ko po kasi nagets kung alin po yung benefit na makukuha if matapos yung 10yrs and still alive? Yung face value po ba or yung insurance coverage? If yung death benefit na makukuha is 200% of face value, how abt the living benefit? Thanks!

Hi Kat. Re: Maxilink Prime, it is the Fund value that is withdrawable up to certain time as long as you’re still living (living benefit). Upon death of the insured, it is the Death Benefit which is Fund Value + Insurance coverage (200% of the face value).

Hi Sir! I have a maxilink prime and im on my 2nd yr. I paid my annual due 20 days late from due date. Before my payment, I noticed that my current fund value is less than the original fund value. Is the reduction in fund value attributed to the monthly periodic charges? If yes, is the charges more since I paid late or it will just be the same even if I paid on time? Thanks!

Hi John, normally it will always be less than the original value. After paying the required number of years, dun palang xa halos nagsisimula kumita.

Nagresign yung FA ko sa Sunlife, nag text ang Sunlife na mag aassign ng bagonf FA para sa akin, gusto ko sana mag ask kung pwede bang mag request ng advisor na taga dito lang malapit sa amin sa home ko yung ma assign sa akin? Taga Makati kasi yung previous na nagresign na.Sister ng kawork ko before.

Sana matulungan nyo ako.

Hi John. Even though they assign a new Sun Life advisor to you, you can still look or change advisor. May I know kung taga san ka? Baka matulungan kita. 😀

Hi , ask ko lng po san makikita ung posting ng monthly payment ksi wala ng dumarating na o.r sa bahay…Monthly po akong nagbabayad..thank you

Hi Rodel. You may register your account / policy to http://www.sunlife.com.ph. You may monitor your account using the online account or mobile app called Sun Life PH.

Hi Gary,

I have been checking your page every now and then and read all your comments. My family has a Sun Life Policy. Me, my husband and my son (6 yrs old). Reflected sa Contract na hanggang 88 years old covered kami by the way Flexilink siya pala. Ask ko lang kung ang payment ba nun is until mag 88 years old kami or 10 years? Thank you so much in advance!

Hi Blair. Sun Flexilink is what we call Regular pay VUL. By design of a regular pay VUL, the payment are continuous up to age 88. So please expect that you will receive a billing statement up to age 88.

But don’t just panic yet if your advisor says you only need to pay 10 years. That is also possible using the Premium Holiday option wherein in the proposal, it can be generated in such a way that if a client opt to pay only 10 years, will it be able to absorb future charges? In most cases, if you don’t have a lot of riders attached, this is possible. But if you do have a lot of riders, these can eat up on the fund value in the long run.

Hi Sir,

Tanong ko lang po sana problem ko sa payment. Kumuha ako ng policy 10k monthly. The problem is na-lay off ako sa work due to company bankrupcy. Possible po ba na pwede kong irequest na babaan na ang payment ko from 10k monthly or 30k quarterly into 3k monthly? Nabibigatan na po kasi ako, ayaw ko naman ipullout kasi magagamit ko sya in the future. At yung naihulog ko po ba eh pwede ko iconvert sa new payment amount na irerequest ko? Salamat po.

Hi Roman, yes pwede idowngrade. Just contact your Sun Life advisor so he/she can help you with the process.

Hi po. Tanong ko lang if possible magchange ng plan. I have a flexilink vul. Sa proposal po kase I thought na for 15 years lang syang payable, only to found out later na hanggang 88yo pala. Wala rin pong inoffer na ibang plan yung FA ko kaya late ko na ding nalaman na may mga plan na payable ng mas maikling panahon.

Thanks in advance po

Hi Ars, Flexilink is very flexible. Possible xa na 15years payment lang via Premium Holiday. It means kahit di mo tapusin gang age 88, as long as may enough fund value to cover future expenses, insured ka padin. Best to monitor your policy din thru our Sun Life PH mobile app.

Hi Garry. I’d like to ask a few questions with regards to my Sun Maxilink Prime.

I missed a quarter of contribution (August 30) due to unexpected company bankruptcy. I understand, from the comments above, that the missed contribution has been deducted from the total fund value of my VUL.

But since I’m going to start again making contributions this November 30, will it continue to deduct from the total fund value, unless I double my contributions before the due date? Or is it okay to at least make 1 contribution to my plan first? I’m willing to continue with my plan with the latter question, since I’ve yet to recover from my financial constraints.

Thank you in advance!

Hi Vinci, for one, your total quarterly contribution was not necessarily deducted as a whole in your fund value. It simply deducted the monthly insurance charges as scheduled and will continue to do so over time.

What you actually missed in your skipped payment is the opportunity to add new units to your policy. By any chance, your policy will continue to be in-forced as long as there’s enough fund value to cover for the monthly charges. So in case you missed a quarter, just make sure you complete the required payments on time so as to keep it on scheduled as projected.

Hi Val, I feel sad about your experience. Usually these things happen when expectations are not met or not fully explained. Basically, yes there are charges starting on the 1st year til the end of your policy.

I’m trying to write an article about VUL Charges as I’ve been receiving quite a handful questions about it. Hopefully I get to publish it next week.

Hi, kumuha ako ng maxilink prime sa advisor ko. Nitong july 2018 lang. Then nag initial payment ako ng 9k, ksi 3k ako monthly.

Good for 3 months na yun. So ang next due date ko is nov 2018 pa dapat.

Sa 9k, 5k+ lang ung natira pambili ng units. Tapos sa transaction history ko, pagka bayad ko ng july 2018.admin charges agad.

Tapos pag check ko ng aug 2018 may admin charges ako, na kinuha sa unit fund value. Hay sept 2018 na ngayon, halos maubos n fund value ko, 2k nlng natira. Parang nag sayng lang ko ng pera. From 9k to 2k. Ambigat para sa isang tulad ko.

Akala ko ung advance payment na 3months, wala p muna ako bayarin for 3 months. Un pala, monthly ako may admin chrges from 1100 units to 486 units. Inubos lang ng admin charges ung units ko. Tsk.

Sobrang na mis inform ako, un pala. Dapat nagbayad ako agad by july at aug. Hindi pala advance payment ung 9k na nilabas ko.

Hi, my sunlife payment is quarterly. My deadline is this coming sep 15, 2018. Quarterly bill is 7,500. is it okay to pay 5,500 only on sep 15 then the remaining 2,000 will be paid on Sep 29? will it affect my VUL policy?

Hi Vrea, yes that’s ok. Your payment will reflect 5,500 and 2,000 on their respective dates.

Hi question po, first time ko lang po magsunlife kaya sinisigurado ko po kung kaya ko ung payment. Nung nagsign up kami ng friend ko gusto namin monthly ung payment ma autodebit sa account namin sabi samin possible daw ang monthly so hiningian kami ng isang quarter for first payment. Tapos nag ask kami when ang next payment namin for 5,000 sabi samin september 2018 dun na daw magstart ang monthly payment namin nagulat kami biglang isang quarter nanaman ung bill namin. Ang concern namin nag agree kami for monthly na 5k kase thats within our budget. Pero para singilin ulit kami ng 15k mabigat un for us. Khit pa isang quarter na payment un. Monthly nga usapan namin. Mejo nagaalala kami kase buti nd pa naenroll ung autodebit namin. Kaya nd pa nabawas ung ganun kalaki.ma aamend pa po ba un? Possible ba tlga ang monthly gaya ng sabi samin? Thank you.

Hi Jeng, yes possible ang monthly. However, you should be enrolled to auto debit arrangement. Most likely kaya dumating ung billing sa inyo na 2nd quarter is simply because di pa naenroll ung Auto Debit Arrangement.

But don’t worry, kahit na 15k ung billing sa inyo, you can still pay kahit 5k monthly. Disregard nyo na lang ung billing statement since it’s auto-generated. Once mag ok na ung Auto Debit Arrangement, you shouldn’t be getting that notice.

Also, make sure that the Auto Debit Arrangement, naka indicate na monthly, otherwise if quarterly ung initial setup, it will be deducted on a per quarter basis also.

good day! kumuha ako ng maxilink bright for my son almost 2 yrs. na kaya lang nung ngbakasyon ako nakita ko yung policy iba po yung work add ko, kinausap ko yng advisor ko eh nasa US na pala kaya nirefer ako sa iba, sabi wala nman daw prob., pingfill up ako ng non-financial amendment form, sabi ok na daw, wala poba magi2ng prob. un pagdating ng araw ngtaka lang ako kasi nilagay nila doha qatar dapat baku azerbaijan po. thank you.

Hi Ms. Cristina, just to clarify. When you signed up your application, were you working in Azerbaijan that time or not?