Good news Sun Life investors! Our long awaited request has finally come to life – Auto Invest with Sun Life Mutual Funds, a program that enables clients to subscribe regularly into peso-denominated Sun Life Prosperity Funds thru automatic deductions thru their bank accounts.

Auto-Invest is open to all existing Sun Life Asset Management Company Inc. clients who are also depositors of Banco de Oro (BDO), Bank of the Philippine Islands (BPI), Security Bank and Metrobank.

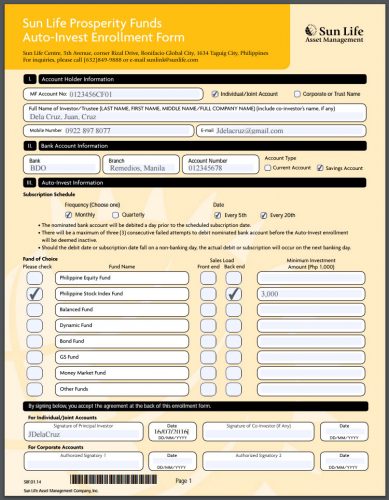

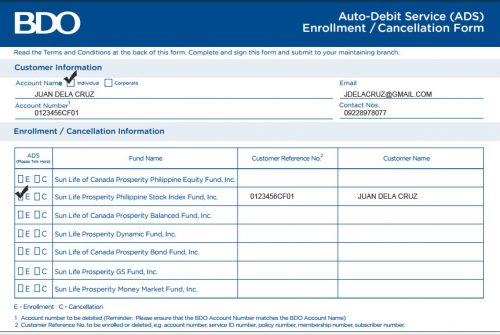

Clients will just have to download and fill up 2 documents namely (click to download)

Once done, they can simply submit both forms to any Sun Life Customer Center or simply give it to their Sun Life Advisors.

Frequently Asked Questions on Sun Life Auto-Invest

What is Auto-Invest?

Auto-Invest is a regular investment program that enables clients to invest monthly, straight from their bank account. It’s a hassle-free way to achieve prosperity and secure a brighter future.

Who are eligible to enroll in the program?

The Auto-Invest program is open to all existing account holder of any of the six (6) participating Sun Life Prosperity Funds, who are depositors of our partner bank:

- Sun Life Prosperity Philippine Equity Fund

- Sun Life Prosperity Philippine Stock Index Fund

- Sun Life Prosperity Balanced Fund

- Sun Life Prosperity Bond Fund

- Sun Life Prosperity GS Fund

- Sun Life Prosperity Money Market Fund

By enrolling, clients are allowing their bank to automatically transfer funds from their bank deposit account to be invested in their SLAMCI Mutual Fund Account/s (Sun Life Prosperity Funds). They will be asked to select which SLAMCI MF Account/s are to be enrolled in this facility.

Enrollment procedure:

- Completely fill-up the following forms: (1) BDO Auto-Debit Service Enrollment Form and (2) Sun Life Prosperity Funds Auto-Invest Enrollment Form. These forms are available at any Sun Life Customer Center.

If they wish to enroll multiple Sun Life Prosperity Funds, they may do so by selecting the fund names in the Sun Life Prosperity Funds Auto-Invest Enrollment Form. - Submit three (3) copies of the signed and accomplished forms to any Sun Life Customer Center or Sun Life Financial Advisor. Partner banks will NOT process these enrollments at their respective bank branches.

- Clients will be notified through SMS and/or email once the account is successfully enrolled.

- Clients will receive an SMS and/or email notification for each successful subscription.

- Clients may verify your bank deposit account history through their bank’s online facility.

Why should I enroll in the auto-invest facility of my bank?

There are a number of benefits in auto-investing:

- Peso cost averaging – Small investments over time will allow you to benefit from the market movement.

- Automatic contribution schedule – This feature compels you to invest regularly.

- Earning from excess cash – This facility allows you to invest a portion of your excess cash, and prevents you from spending all of your disposable income.

- Cashless transaction – You will enjoy the convenience of online banking by using the automatic debit facility of your bank. No monthly bills, no fund transfers, no queueing.

- Free and safe online service. – This on-line service is free of charge. However, standard fees for early redemption apply.

Is my money safe with the Auto-Invest program?

The security features of SLAMCI and that of our partner banks’ systems ensure investor protection. Clients may monitor their bank deposit account by viewing their transaction history.

How often will you collect from my bank deposit account?

The Sun Life Prosperity Funds Auto-Invest Enrollment Form has set a pre-determined monthly subscription schedule, which is every 5th or 20th of the month. Funding must be available at least a day before subscription date (i.e. Account to be debited every 4th or 19th of the month for subscription the following day). Should the subscription schedule fall on a weekend or holiday, the transaction will be moved to the next banking day.

What happens when my funds are not sufficient?

Bank deposit accounts with insufficient funds will receive notification via SMS and/or email of the failed subscription. After three (3) months of unsuccessful attempts to collect, their enrolment to the Auto-Invest facility will be cancelled.

What if I want to stop the service?

To discontinue the Auto-Invest service, please fill-up and submit the Cancellation and Amendment Form at the Customer Center.

What is the minimum amount for each subscription?

The minimum investment amount for each subsequent subscription is P 1,000.00.

Garry De Castro is a personal finance advocate, Financial Advisor, Certified Investment Solicitor (Mutual Fund Representative), investor, stock market trader, blogger, and IT practitioner. He started sharing and writing financial articles 2008 just to share his financial learnings to friends, relatives and anyone who wishes to be financially independent.